Red Oak Financial completed a $9,000,000 refinance loan for a five-building, 54,900-square-foot, industrial property situated on 5.93 acres in the Southwest region. Once stabilized and current tenants’ 15-month leases expire, the asset will be consistent with the existing use as a multi-tenant industrial as an interim. Subsequently, assemblage and redevelopment planning can commence to convert the site into a mixed-use retail/residential/recreational property. The location of the property has a major advantage being in close proximity to well-known gaming and leisure firms, as well as new developments being constructed/improved within the market.

Featured Transactions

The security for the loan consists of a two-building industrial complex containing 472,903 square feet of net rentable area situated on 91.10 acres. The property in located in Witchita Falls, TX approximately 100 miles northwest of Dallas, TX.

Red Oak provided $1,733,750 in financing to purchase and rehabilitate a three-story 40,000-square-foot office building located in Homewood, AL in the Birmingham market. The property at 85 Bagby Dr.is a multi-tenant general use office, located just off Hwy I-65 in the market’s CBD. The buyer is an experienced property developer and manager. The building was 80% occupied and will undergo regular updating and renovations to bring it up to a Class A/B building. The borrower expects occupancy to hit 100% withing six months. The site is located directly across the street from a new $21-million public safety building, which will house all public safety departments. Conventional financing was not available for the property as a result of maintenance and upgrades needed, as well as the high vacancy. Red Oak understood that the asset performance however was strong, with a net operating income of $243,541 and an expected DSCR of 1.25. The borrower’s exit strategy is to obtain conventional financing after the rehabilitation and stabilization is completed, in approximately 6 to 8 months.

SOUTHEAST OFFICE PARK OPPORTUNITY The Sponsor and its investment company recognized an opportunity to acquire a mismanaged and poorly maintained office park in a suburban Southeast market, adding value through targeted capital improvements, leasing and stabilization of the asset. Occupancy levels at the time of purchase were well below the submarket averages due to the […]

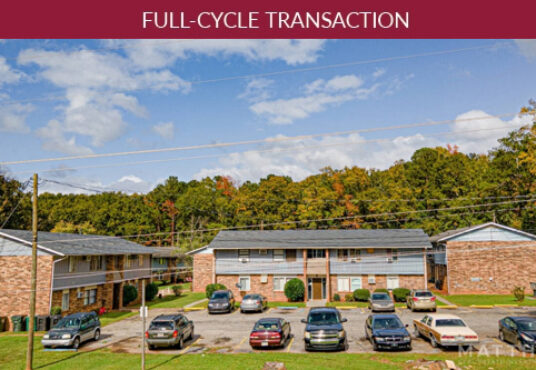

Opportunity The borrower, through their intermediary, came to Red Oak to finance the acquisition and renovation of a four-building, two-story apartment complex containing 33 units built in phases between 1977 and 1979, located in Alexandria, Kentucky. At the time of purchase, the property was 100% occupied but with below market rents. The Sponsor saw an […]