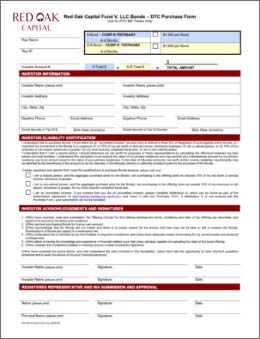

red oak capital

fund v, llc

reg a+ tier ii bond

Red Oak is currently raising capital for Red Oak Capital Fund V, LLC which will provide investors with the opportunity to purchase bonds backed by senior position, short-term, income producing commercial real estate assets.

BOND YIELD: 7.5%

MINIMUM INVESTMENT: $10,000

OFFERING SIZE TARGET:

$75,000,000

STATEGY: CRE LENDING

Key Terms & structure attributes

| ISSUER | Red Oak Fund V, LLC |

| OFFERING TARGET | $75 Million - Regulation A+, Tier II Bond |

| INVESTOR QUALIFICATIONS | General Solicitation |

| MINIMUM INVESTMENT | $10,000 |

| TERMS - BROKER DEALER | 7.50% Senior Secured Bonds (Series B Bonds), Matures 12/31/2027 |

| TERMS - FEE BASED | 8.00% Senior Secured Bonds (Series Br Bonds), Matures 12/31/2027 |

| INTEREST PAYMENTS | Paid quarterly in arrears: January 25, April 25, July 25, October 25 |

| CONTINGENT INTEREST PAYMENT | Contingent interest payment will be equal to the spread times 20% |

| OFFERING PERIOD ENDS | December 31, 2022 |

| OFFERING & REPORTING | Regulation A+, Tier II |

| TAX | 1099-INT |

| REPORTING | ¹ Audited annual financials, semi-annual financial reporting, quarterly notices & portfolio snapshots |

| CREDIT FACILITY | May use credit facility to bridge operational cash flows |

| INVESTING | Existing cash-flowing commercial real estate in US and US Territories |

| VALUATION | In accordance with US GAAP; fair value will be audited annually |

¹ This summary of key terms is qualified in its entirety by the complete description of terms related to this Offering set forth in the Cofidential Private Placement Memorandum for the same.

DISCLAIMER: There is no assurance that any strategy will succeed or that this program will meet its investment objectives. Please review “Forward Looking Information” disclaimers on the proceeding pages.

what is a reg a+ offering?

Raymond Davis, Chief Business Development Officer at Red Oak Capital, and Robert R. Kaplan, Jr., partner at Kaplan, Voekler, Cunningham & Frank, illustrate how the Reg A process works and how it is best utilized with the number of capital raising channels and options available to the public.

CONTACT US

To request information about our company, please contact us and someone will be in touch shortly.

DISCLAIMERS

The contents of this website and/or any related webpage links do not constitute an offer of securities or a solicitation of an offer to buy securities. Securities offered through Crescent Securities, LLC, Member FINRA/SIPC. Crescent Securities is not affiliated with Red Oak Capital Holdings, LLC, [or other entity] or any affiliate thereof.

The information on this website is for informational purposes ONLY and does not constitute an offer to sell or the solicitation of an offer to purchase securities. Any such offer will be made solely by means of the offering circular contained in a qualified offering statement. The information contained herein may not be used in connection with an offer or solicitation by anyone in any jurisdiction in which such offer or solicitation is not qualified or to any person to whom it is unlawful to make such offer or solicitation. Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved or passed upon the accuracy or adequacy of these materials.

This website contains forward-looking statements. Forward-looking statements are typically identified by the use of such terms as “may,” “should,” “could,” “intend,” “plan,” “anticipate,” “estimate,” “believe” or the negative of such terms and other comparable terminology. Such forward-looking statements are based upon current plans, expectations, estimates, assumptions and beliefs that involve numerous risks and uncertainties related to future economic and/or market conditions, as well as future business decisions, which are difficult or impossible to predict accurately or which may be out of the [entity]’s control. Actual results could vary materially from those set forth in such forward-looking statements.

The offering statement of the company and the most recent offering circular can be found at:

https://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0001817413&owner=include&count=40&hidefilings=0